Jul 11, 2023 — Your cellphone provider doesn’t typically report your payments to credit bureaus. They can still help you build your credit.

Can you use your cellphone bill to build credit?

https://www.bankrate.com/personal-finance/credit/can-cell-phone-bill-build-credit-score/

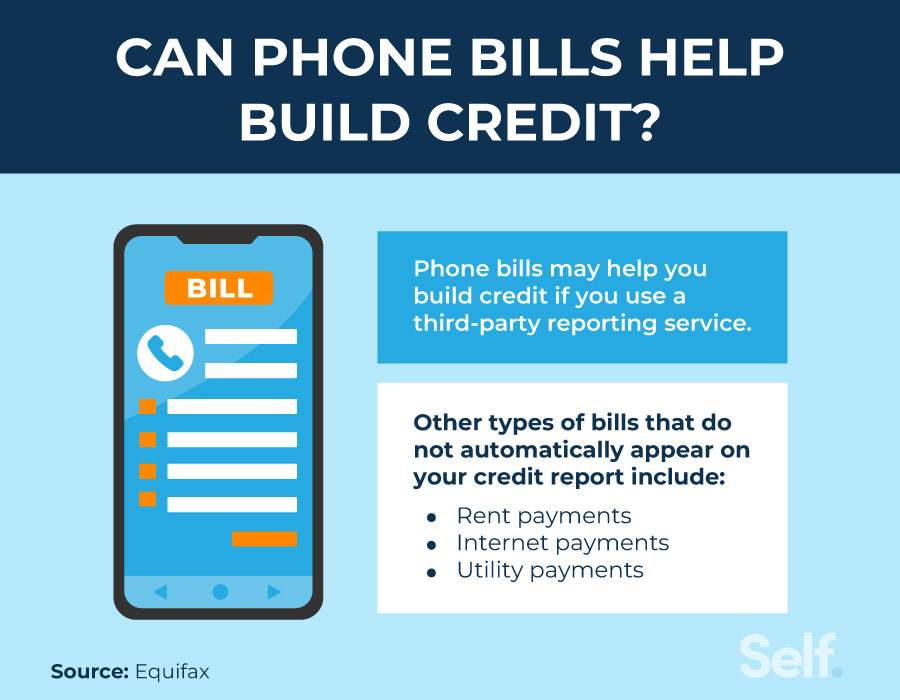

Short Answer: Paying your phone bill on time does not typically help build credit. However, there are ways to add your positive payment history to your credit report, such as using third-party services like Experian Boost or paying your phone bill with a credit card [1][2][3].

Understanding Credit Building

To understand how a phone bill can impact your credit, it’s important to know how credit building works. Your credit score is calculated based on various factors, including payment history, credit utilization, and credit history. Payment history accounts for 35% of your FICO Score, which is commonly used by lenders to assess creditworthiness [2].

Phone Bills and Credit Reporting

Typically, cellphone providers do not report regular bill payments to credit bureaus. This means that simply paying your phone bill on time each month will not automatically increase your credit score [2]. However, missed payments or late payments can negatively impact your credit score if your cellphone account becomes delinquent. Negative information, such as delinquency or accounts sent to collections, can stay on your credit report for up to seven years [2].

Adding Phone Bill Payments to Your Credit Report

While cellphone providers may not report your payments to credit bureaus, there are ways to add your positive payment history to your credit report:

-

Third-Party Services: Some third-party services, like Experian Boost, allow you to add your cellphone bill payment history to your credit report. These services report your payment activity to the credit bureaus, potentially improving your credit score [2][3].

-

Paying with a Credit Card: Another option is to pay your phone bill with a credit card. While the cellphone provider may not report the payments, using a credit card to pay your bill can help build a solid payment history. Make sure to pay off your credit card balance in full and on time each month to avoid interest charges [2].

Benefits of Building Credit

Building a good credit score is important because it demonstrates your creditworthiness to lenders. With a good credit score, you may have better access to loans, lower interest rates, and premium rewards cards. It can also help you achieve your financial goals and save money in the long run [2][3].

Additional Credit Building Strategies

In addition to adding your phone bill payments to your credit report, there are other strategies you can use to build credit:

-

Secured Credit Card: Consider applying for a secured credit card, which requires a cash deposit as collateral. Using the card responsibly and making timely payments can help improve your credit score [3].

-

Retail Credit Card: Some retail stores offer credit cards with less restrictive requirements. Using a retail credit card wisely and paying the bill in full each month can help build a positive payment history [3].

-

Reliable Cosigner: If you have difficulty qualifying for a loan, having a trustworthy cosigner with good credit can increase your chances. Make sure to make all payments on time to avoid negatively impacting your cosigner’s credit [3].

-

Authorized User: Becoming an authorized user on someone else’s credit card can help build credit if the primary cardholder uses the card responsibly. Ensure that the card issuer reports authorized user accounts to the credit bureaus [3].

-

Secured or Credit-Builder Loan: Consider applying for a secured loan backed by collateral or a credit-builder loan offered by credit unions. Making timely payments on these loans can help establish a positive credit history [3].

Sources:

- Chase Bank – Can financing a cell phone help me build credit?

- Bankrate – Can Your Cellphone Bill Help You Build Credit?

- Experian – How Can Cellphone Bills Help Build Credit?

Learn more:

How Can Cellphone Bills Help Build Credit?

FAQ

What bills build credit?

What builds credit the fastest?

Want to know how to build credit fast? Start by making on-time payments. Then work on paying off old debt and adding new lines of credit to your portfolio. As your credit score improves, keep practicing good credit habits like keeping balances low and avoiding unnecessary credit inquiries.

How long do cell phone bills stay on credit?